8 Tips to filing US Taxes Abroad

To all my Americans living abroad, it’s that time of year to file taxes. It is indeed nothing to get excited about but it is something to make sure you check off your to do list. If you are wondering where to start with filing taxes abroad, haven’t ever filed abroad, or looking for affordable tax filing solutions you are in the right place.

As an American expat living abroad since 2011, I’ve learned the hard way that even though I’m not living in the US anymore, I am not exempt from filing taxes. Once I moved abroad I basically forgot about US taxes since I was working in France, not earning income in the US, and paying taxes in France. I had so many French admin things to take care of from renewing my visa, finding an apartment, as well as navigating French taxes that remembering that I had to also file taxes in the US was the last thing on my mind. I ended up not filing for almost 7 years which is so bad (I know), but I finally got my act together. I didn’t know when I would like to move back to the US, and I didn’t want to have outstanding taxes to potentially come up as a problem so I did a bit of research on how I could back file taxes. I ended up seeing an international tax lawyer who helped me to get it together and they encouraged me to make it a priority to file every year to avoid the hassle of backfilling again.

The process of backfilling taxes was a very time and energy consuming lesson learned, and I’m a huge advocate now of making sure you have all your ducks in a row in the country you are living abroad, as well as your home country. As daunting as US taxes may seem, filing taxes abroad isn’t that bad. Through trial and error of sorting out US taxes abroad, I came across some useful resources and tips which I am going to share in this blog post that will hopefully make filing more of a breeze.

8 Tips to filing US taxes abroad

This year, my filling has become a little more complicated and I wanted to get a little extra assistance instead of trying to file myself. I came across MyExpatTaxes, which is a tax software that is specialised in filing for Americans abroad, digital nomads, and pretty much anyone who is American by default living outside of the US that would need to file.

I’m excited to be collaborating with MyExpatTaxes who have sponsored this post, and I will be providing helpful information I have learned from them as well as my honest feedback on using their services. It is also important to note that I am not an expert in US taxes, and this blog post is merely meant to serve as a resource and not certified tax, accounting or legal advice.

1. General Tax Filing Information

In general, when preparing to file your taxes it is important to stay up to date on the most recent deadlines and tax updates. The IRS website is a great place to start for the most up to date information as well as the access to potential forms you may need.

When I was trying to sort out back filing my taxes, I spent a lot of time looking for helpful websites to explain the process and was overwhelmed with websites that were trying to sell a service to file that didn’t look reliable, so it is important to really vet where you get information from.

2. Yes you have to file taxes as an American living abroad

As I mentioned previously, even though you are living your best life abroad, your duties as American still stand, which includes filing for taxes. Any US citizen living abroad is required to file taxes, and this even includes “Accidental Americans” (a term I recently discovered via MyExpatTaxes).

Accidental Americans are:

Those who were born in the US to foreign parents

Those who were born abroad to a US parent who claimed citizenship for you

Those who were born abroad to American parents unaware of their American citizenship and claimed citizenship for you

Those who had obtained a US birth certificate or citizenship around the time of birth (even if you’ve been living abroad for longer than you’ve lived in the US)

To make sure you have to file you need to check based on your filing status and your worldwide income which you can find on the IRS website.

If your worldwide gross income reaches or exceeds the filing profile threshold above, you are required to file US taxes.

3. Mark you calendar: US Tax Deadline

One of the good things about living abroad is that American expats get an automatic two month extension to file. This year the deadline to file for US expats is June 15th. If for some reason you can’t file by this date, you can request an additional extension that will give you until October 15th.

4. You have to file, but you most likely don’t owe anything

I know it sounds scary to have to file US taxes abroad, but don’t worry you most likely won’t owe anything. Think of it more as an action you have to do based on principle so that you don’t run into any issues or penalties down the line with the IRS.

Thanks to tax benefits and exclusions like the Foreign Earned Income Exclusion (FEIE) if you are living and working abroad you aren’t going to have to pay taxes where you are living as well as in the US. There are about five different benefits and exclusions that prevent Americans from double taxation on foreign-income and owing unnecessary fees which you can learn more about here.

5. US Expats are eligible for Covid relief stimulus checks

I was pleasantly surprised to learn that US expats abroad are eligible to receive Covid relief stimulus checks. To date, there are three stimulus checks and you haven’t received your first one. You are still able to receive them retrospectively once you file your 2019/2020 taxes and you can check how much you qualify for using the MyExpatTaxes Stimulus Check Calculator.

6. Haven’t filed in years- Backfilling is a possibility

If for some reason you have been living abroad and haven’t filed your US taxes like me (no judgement here), don’t worry there is a way to resolve this. You can back file using the Foreign Streamlined Compliance Procedure, which allows you to file delinquent taxes and to back file for the past three years. I hadn’t filed for a total of seven years, and through the Streamlined procedure I was able to back file and rectify my years of unfiled taxes. I ended up submitting all the necessary forms on my own which was a bit tedious, and it required looking up information for my income for the past three year. I managed to sort everything, but if you need assistance with this process, MyExpatTaxes offers solutions to complete this process.

7. FBAR Form

When filing your taxes and reporting on your worldwide income, it is important to make sure you fill out all the appropriate forms such as the FBAR (The Foreign Bank Account Report) form.

If you have had at least $10,000USD total in all your foreign bank accounts at any point during the tax year, you need to convert your foreign currency to USD and you will need to fill out the FBAR in addition to your standard tax forms. You can download the FBAR forms from the IRS website or you can file them with your preferred tax filing software such as MyExpatTaxes which can help you do this in 15 or so minutes. If you are not sure you need to file an FBAR it is good to keep an eye on your foreign bank accounts, and to file to be safe than sorry because failure to file one can end up with penalties (up to $10K) which isn’t worth the risk.

8. Choose the best filing method for you

After doing your research it's time to actually file by choosing the best option for you based on your situation and budget. You can go the “do it yourself” method and file directly via the IRS. You can choose a CPA or your preferred tax filing software. Last year I went with the DIY filing because my filing status was pretty simple, but this year my taxes are a little more complicated so I am filing with MyExpatTaxes for a little extra support and so that I can try to maximize my return.

After successfully using the MyExpatTaxes software here are the biggest takeaways from filing my taxes with them.

Informative

I found MyExpatTaxes to be really informative. They have a blog that is worth checking out that has a lot of helpful posts on various topics ranging from figuring out if you need to file taxes, FBAR guide, down to information on Covid stimulus checks. All of their blog posts are verified by IRS enrolled agents and CPAs and broken down into easy to understand information.Specialized in Expat taxes

As a long-term expat, it isn’t always easy to find tax resources that are geared specifically to expats. One of the biggest things that I like about MyExpatTaxes compared to other tax software is that they have expertise specific to Americans living abroad. Their services give you peace of mind knowing that your unique situations to being an expat are taken into account when filing with their software.

Software easy to use & secure

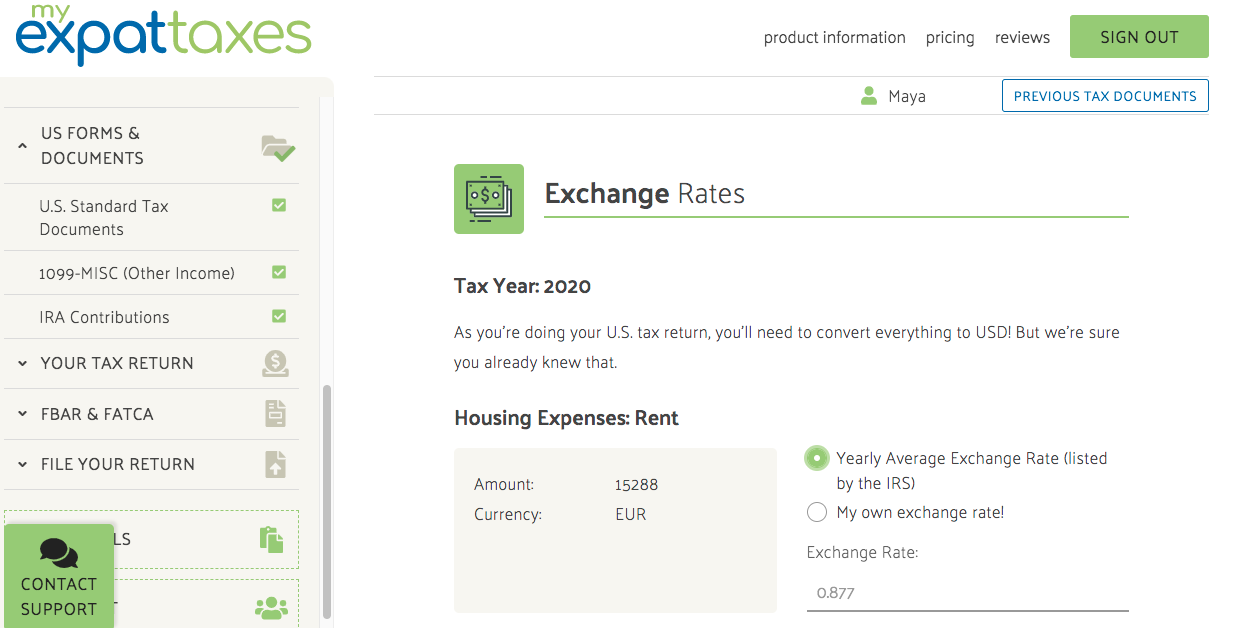

Taxes can be scary and overwhelming but MyExpatTaxes approach makes you feel at ease as it is simple to navigate through the different sections of the filing processes. For example, they make tasks unique to expat taxes such as converting foreign currency simple by offering the pertinent IRS exchange rate for the tax year your filing for or you can use your own rate that you calculate manually.

In terms of security, anytime I have to take care of sensitive information online, I am always worried about the safety of my personal information. MyExpatTaxes software has an experienced IT team behind it with over 20 years of experience, and they ensure that client data is not shared with third parties, except the IRS tax authorities (which is the point of their software).

Maximize return (rebates)

I always used to hear the term “tax deductibles” thrown around and I never really paid attention to how I could actually benefit from them. MyExpatTaxes asked questions regarding different potential deductibles, that I wouldn’t have taken the time to explore on my own which helped me to maximize my return this year.For example, they have a section for itemized deductions where it really breaks down your potential deduction categories and you can make sure to list the deductions that apply to you such as foreign rent/mortgage, rental of furniture, property insurance, etc.

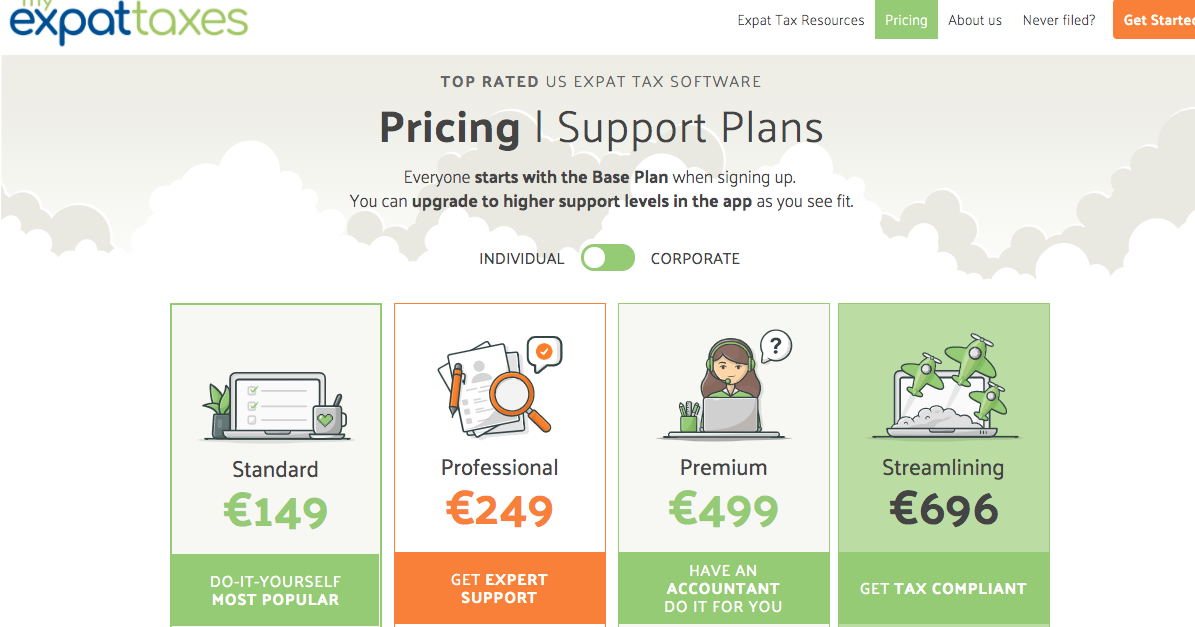

Affordable rates

Although I was able to try their service for free, after using it and seeing their rates I think their prices are fair and affordable for the service they offer. For example, for the Foreign Streamlined Assistance they charge 696 euros, and when I went to see an international tax lawyer the service was over 1500 euros for them to due the process for me.

My Expat Taxes Discount Code:

If you’re interested in filing using MyExpaTaxes you can use my discount code LAVIELOCALE for 10% off.

Well there you have it, tips to filing taxes abroad as well as first hand feedback from using MyExpatTaxes to file. I hope you find this post helpful, and if you haven’t already make sure to file your taxes before the upcoming deadline (June 15,2021) for American expats abroad.